Table of Contents

ToggleQuickBooks General Ledger keeps a record of all your documents and financial transactions in the business. Therefore, It is a record of your past and present financial transactions. It is essential to understand how general ledger works and operates primarily for small business owners.

As a result, General ledger keeps you at the top of your financial documents and what they mean to your business.

How does QuickBooks General Ledger Works?

Let us learn how General Ledger QuickBooks works here.

- You need to make entries to your accounting system every day to check invoices, deposits, etc. Transactions about all these entries go to the general ledger. You write a check to pay rent; then the transaction will hit two accounts, in General, It will credit your business bank account and simultaneously debit your rent expense account.

- QuickBooks General ledger utilizes the double-entry accounting method. This is a recommended method for all businesses except if you are a solopreneur. The single-entry accounting method is correct. Every account of General Ledger needs to have a normal

- Also, keep in mind that not every transaction will hit General Some transactions in QuickBooks Online can be considered as ‘non-posting’ and do not touch General Ledger QuickBooks. Below given is a list of Posting vs. Non-posting transaction in QuickBooks Online

| Posting Non-Posting |

| Invoice Estimate |

| Credit Memo Delayed Credit |

| Sales Receipt Delayed Charge |

| Expense Purchase Order |

| Cash Expense Time Tracking |

| Check Statement |

| Bill |

| Credit Card Expense |

| Payment |

| Bill Payment (Check) |

| Bill Payment (Credit Card) |

| Vendor Credit |

| Deposit |

| Transfer |

| Journal Entry |

| Inventory Qty Adjust |

Non-Posting Transactions

- Estimates – This is that amount which you tell your customer when you are trying to sell them and what will be the price. Currently, no sale has been made

- Delayed Credit or Charge – These transactions are ways to keep track of the services or items for which you need invoice the customer at as after date. At this point also no sale is done.

- Purchase Order or PO – This is a sort of an estimate. It is the estimated amount that you give the vendor when they are planning on buying a commodity. Again no purchase made at this moment.

- Time Track – The time transactions can be utilized to track time to finally show up an employee paycheck or time for which the client will be invoiced at an after date.

- Statement – This is a list of transactions that you have posted to your General ledger.

Also Read: What To Do If QuickBooks Is Unable To Verify Financial Institution?

to resolve your query in no-time.

Why do you need QuickBooks General Ledger?

- Ensure books are accurate- General Ledger is a useful tool and is an effective way to view your spending for an orderly tracking of your business. QB General Ledger helps you detect mistakes made on the data entry or see why where the numbers are not coming right. You can review the General Ledger report to ensure everything posted is correct.

- Track the Financial Expenditures– It is very important to keep track of financial expenditures on a timely basis. Therefore, General ledger can keep you on top of your spending and ensure correct entries are made. For example, you can view the correct entries are made to the right accounts such as vehicle payments that are not allocated to Auto Expense Account but are put to their respective accounts.

- Track Company’s transactions- To track various company’s transactions such as Personal deposit funds to your business bank account, paid business expenses with the Personal funds, the general ledger can help in a great way. It often gets difficult to separate business and personal expenses; however, General ledger helps here.

What are the General Ledger QuickBooks Templates?

There are a few QuickBooks general ledger templates that you can use

- PDF General Ledger Template derived from ‘Double Entry Bookkeeping.’

- Excel General Ledger Template derived from ‘At Your Business.’

- Word General Ledger Template derived from ‘Office Templates Online.’

- Excel General Ledger Template derived from ‘Excel Templates’

All the above-given templates are good and can work for your business. However, we recommend you to use the Excel File template as that allows an easier transition whenever you are looking to upgrade or move to another software.

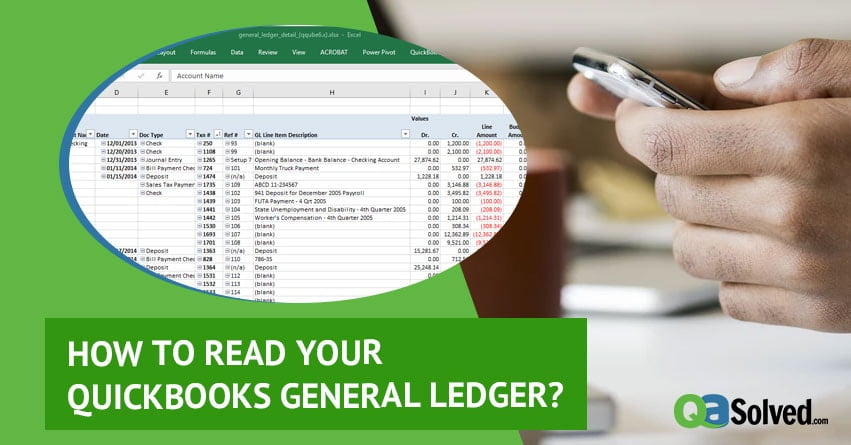

How to read QuickBooks General ledger?

Whether you do your bookkeeping or get it outsourced from someone, it is important to be familiar with the General ledger QuickBooks. Moreover, every financial transaction that has an impact on your business is in General Ledger in the form of a ‘Posted Transaction.’ Thus, it becomes imminent to read your General Ledger.

Classifications

- Asset- In these things such as Cash, Accounts Receivable, equipment, etc. come.

- Liabilities- Accounts Payable, Loans Payable, etc. come in this category.

- Stockholder equity- These are the Common stock or retained earnings.

- Operating Revenue- Revenue that comes in sales

- Operating Expenses- salaries, rent, etc.

- Non-operating revenue and gains- Investment income etc.

- Non-operating expenses and losses- This have interest expense, etc.

- Asset, Liabilities and Stockholder equity accounts can be found on the first page of the Balance sheet. The Balance sheet has permanent accounts in it which do not get closed at the end of the year.

- The rest of the accounts that are Operating Revenue, Operating expenses, Non-operating revenue and gains and Non-operating Expenses & loss account are a part of the Profit and Loss / Income statement.

Note: In case there was no activity done in any some or one of the accounts mentioned above, then you might not see that account reflected while doing the ledger accounting.

Understand all the classifications in detail by speaking to a technical expert at QuickBooks Tech Support.

How is General Ledger different from other Financial Reports?

Now we can know all about General Ledger and its working, its time to compare it with the other Financial Reports.

- Firstly, People confuse the ‘ Chart of Accounts ’ with General Ledger at times. However, they are pretty different. To put it simply, the Chart of Accounts is the list of the accounts that have been made available for keeping the transactions in your ‘General ledger.’

- Secondly, sometimes the user confuses a QuickBooks General Ledger with General Journal. Hinder from confusing both of them as General Journal is simply a chronological record of the transactions.

- The general ledger is a comprehensive summary of the different parts of the accounting. From this source, the various Financial reports are generated such as the Profit and Loss report and the Balance sheet.

Thus, it is necessary to have a look at the accounts regularly, to remain on the top of the financial statements. It is highly recommended to review and evaluate General ledger QuickBooks, Profit & Loss and the Balance sheet every week. If you are using advanced software such as QuickBooks Online where you can generate reports, then it becomes easier to review.

That’s all for this error. Hopefully, the article was comprehensive in giving the required information with which you can analyze and review QuickBooks General Ledger efficiently. In case you find any issue then speak to a technical advisor at QuickBooks ProAdvisor Support Number.

If you ever feel the need of taking advice from your fellow business owners that happened to be our existing subscribers, you can visit our thriving QuickBooks Community. It has numerous answered questions that could lead to resolving many of your QuickBooks related problems.